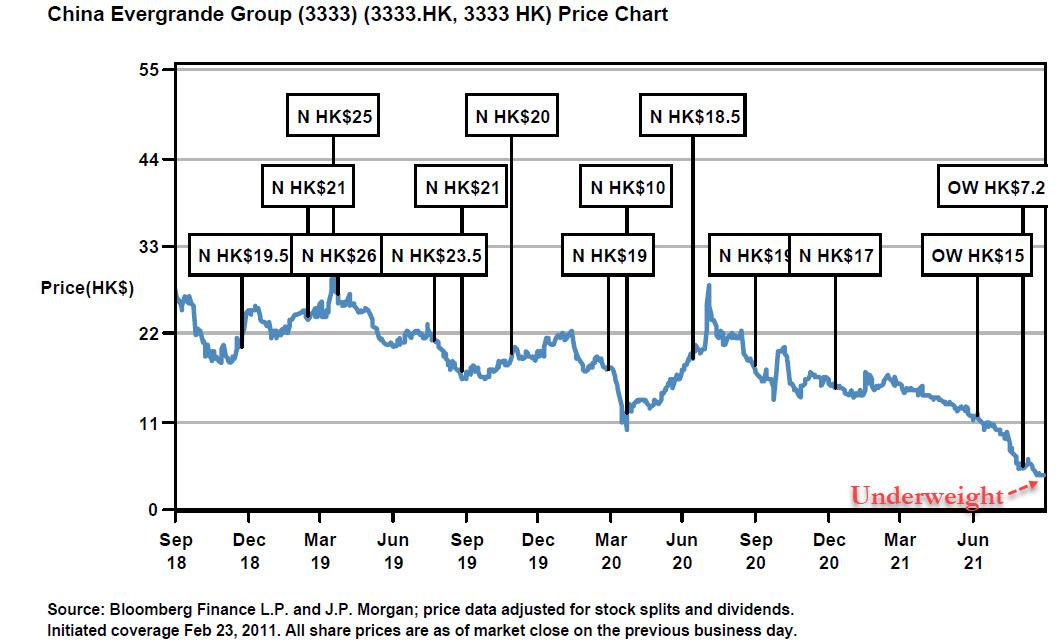

Evergrande Share Price Hk

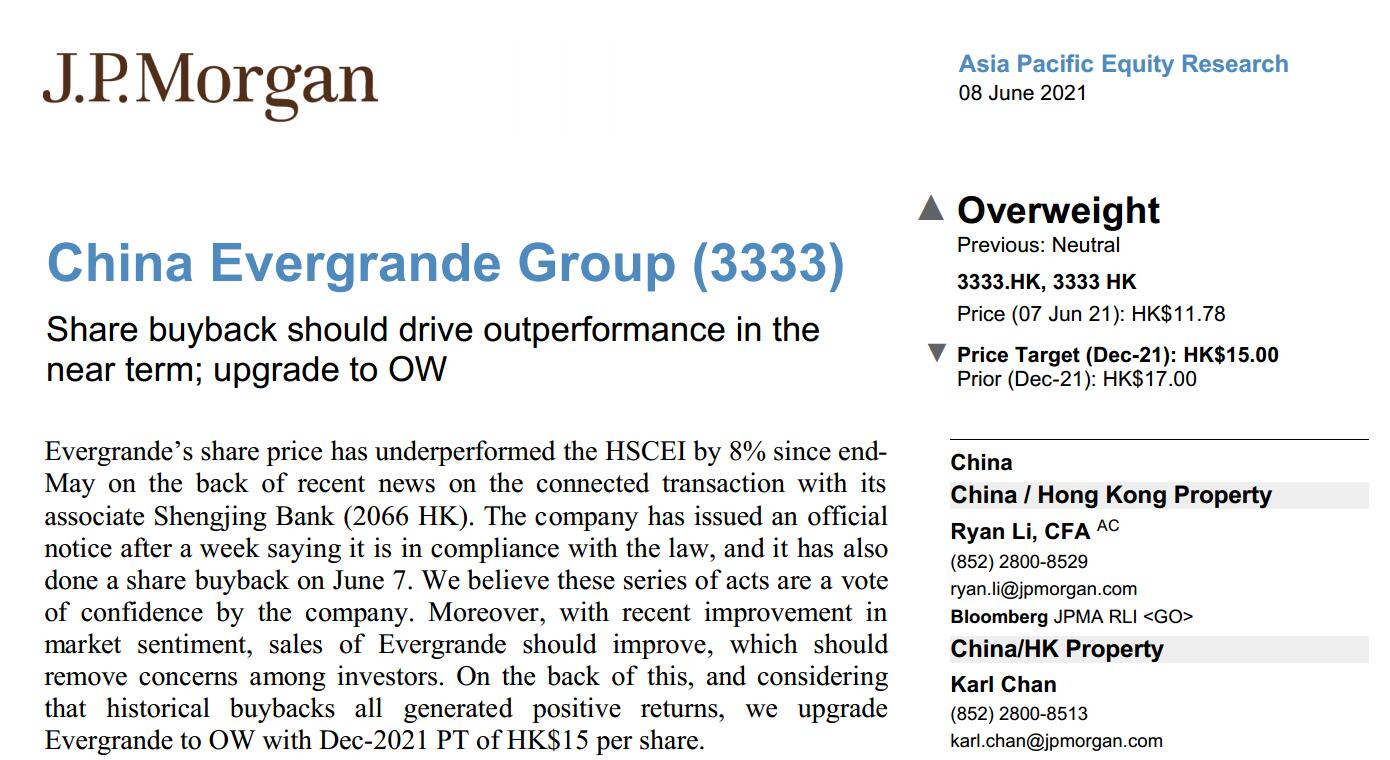

For example Evergrande has expanded into solar panels pig farming agribusiness and baby formula. - China Evergrande announced on June 7 that it bought back 291 million shares worth a total of HK336 million 43 million according to a Hong Kong Stock Exchange filing.

Shares of Hong Kong-listed Evergrande jumped as much as 88 to an almost two-week high in afternoon trade versus a gain of 01 gain in the benchmark.

Evergrande share price hk. The latest on Evergrande the largest casualty of the credit crackdown is more asset sales. The stock had plunged 18 in the past month to its lowest since March 2020. In January shares of China Evergrande New Energy Vehicle Group soared after the unit raised HK26 billion from its billionaire founder Hui Ka Yans usual group of investors.

In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry. Shares in Evergrande dropped over 5 to HK1082 - their lowest level since March last year - before closing up 32 on Monday.

- China Evergrande announced on June 7 that it bought back 291 million shares worth a total of HK336 million 43 million according to a Hong Kong Stock Exchange filing. China Evergrande Groups favored tactic to squeeze bearish speculators is to repurchase shares mopping up liquidity in the stock and driving up its price. Shares of Hong Kong-listed Evergrande jumped as much as 88 per cent to an almost two-week high in afternoon trade on Thusrday versus a gain of 01 per cent gain in the benchmark.

Evergrandes price has dropped a lot and thats helping with the rebound but its hard to say if it can last Evergrandes bonds also rose. Analysts predicted in a recent note where they upgraded Evergrande shares to the equivalent of buy. Evergrande has operational problems more than liquidity problems said a portfolio manager in Hong Kong.

Evergrande Property Services Group slumped in Hong Kong by the most since its December listing after an unidentified seller offloaded several blocks of shares as soon as a six-month lock-up period on key investors expired on Wednesday. China Evergrande Group the countrys most indebted developer rose in Hong Kong trading after the company bought back HK336 million US43 million of shares. Shares of Hong Kong-listed Evergrande jumped as much as 88 to an almost two-week high in afternoon trade versus a gain of 01 gain in the benchmark.

Beginning October 15 2020 market price returns are based on the official closing price of an ETF share or if the official closing price isnt available the midpoint between the national best bid and national best offer NBBO as of the time the ETF calculates current NAV per share. The stock climbed as much as 42 on Tuesday morning in Hong Kong. The market capitalization sometimes referred as Marketcap is the value of a publicly listed company.

More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables. Evergrande explained that the transaction would reduce the ratio of the top 20 shareholders to below 90 paving the way for an inclusion in the Hong Kong Stock Connect a trading link that allows mainland Chinese investors to buy Hong Kong-listed shares. The buyback period could last 15 to 20 days JPMorgan Chase Co.

Unfortunately for the company and its. The stock sank 13 per cent to HK978 at the close of trading on Wednesday erasing the equivalent of US19 billion from its market value. In 2017 Evergrande stocks share price profits and revenue surged to almost three to four times in value propelling founder Xu Jiayin to one of Chinas richest men as.

Bloomberg China Evergrande Group the countrys most indebted developer fell to the lowest in more than a year after investors were spooked by regulatory moves that may stoke risks at the conglomerate. The shares dropped as much as 53 to HK1082 in Hong Kong trading on Monday. Evergrande has operational problems more than liquidity problems said a portfolio manager in Hong Kong.

China Evergrande Group the countrys most indebted developer rose in Hong Kong trading after the company bought back HK336 million 43. The volatility in Evergrandes share price is unlikely to decrease said Castor Pang an analyst at Core Pacific-Yamaichi International Hong Kong Ltd. The company paid HK1108 to HK1184 apiece for the shares about 02 of issued capital it said in a filing to the exchange late Monday.

The stock had plunged 18 in the past month to its lowest since March 2020. As of June 11 it had yet to cancel those shares. The company has spent about HK529 million 68 million on buybacks since June 7 to combat increasing bets against its stock.

The stock has lost 21 so far this year. The developer sold 7388 million shares of Hong Kong-listed HengTen Networks Group Ltd.

Evergrande Statement Boosts Market Confidence Jpmorgan Chase Upgraded To Overweight Rating Newsdir3

China Evergrande Shares Dive To 11 Year Low As Default Risks Grow Arise News

E House China Holdings 2048 Hk Is A Leading Chinese Real Estate Transaction Service Provider Backed By Evergr Bills Receivable Accounting Real Estate Agency

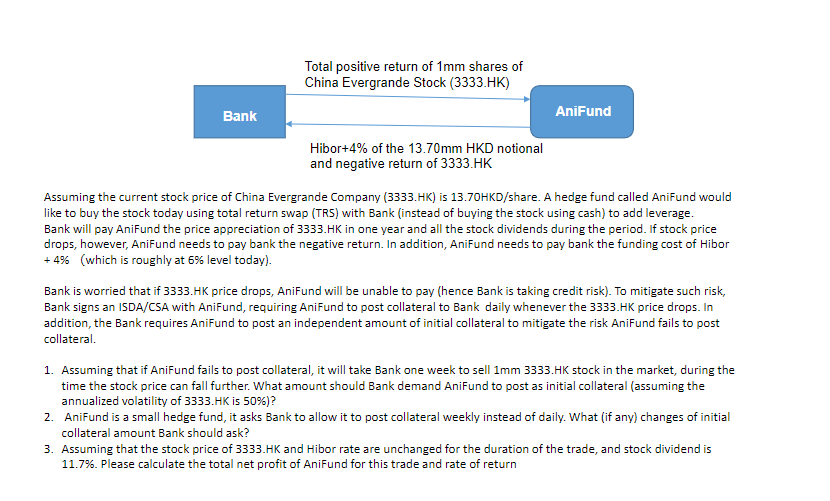

Total Positive Return Of 1mm Shares Of China Chegg Com

Evergrande Shares China Evergrande Shares Plummet On Default Risks The Economic Times

China S Evergrande Shares Slip More Than 16 As Payment Commitments Deadline Approaches By Investing Com Styleheavens

Evergrande Real Estate Group Limited 3333 Hk Started Buying Back Shares July 3rd With No Small Amount Of Vigor What Next Before Running Shares Outstanding